Wood Burning Stove Tax Credit 2025 - Wood Burning Stove We Love Fire, If you're new to woodburning, this is a great space for you. Most other wood stoves just meet the 75% efficiency rating to qualify for a. Congress removed biomass stoves from section 25 (c), which had provided a $300 tax credit up until dec.

Wood Burning Stove We Love Fire, If you're new to woodburning, this is a great space for you. Most other wood stoves just meet the 75% efficiency rating to qualify for a.

APG Outdoor wood gas woodburning stove portable folding firewood stove, All are welcome and so are your questions. Products may be claimed on the tax return year in which the.

Wood Stove and Insert Heater Investment Tax Credit (ITC) On Fire, Two main types of wood stoves meet epa standards for efficiency and emissions. Is there a federal tax credit available for new wood stoves?

WoodBurning Stove Tax Credit, We recommend consulting a qualified tax professional to determine if you are eligible to take advantage of this tax credit. Since january 1, 2025 until december 31, 2032, if you are buying a woodstove with a hhv efficiency higher than 75%, you will be able to claim a 30% tax credit that is capped at.

Want a WoodBurning Stove? Now Is a Great Time to Get One, What is the 26% tax credit for wood stoves? Products must be claimed on the tax return year in which the product installation is complete.

Congress Increases Tax Credits For Wood and Pellet Heaters Cookstove, We are referring all questions regarding the current 26% federal tax credit on wood heaters (known as the. Details of the 25c wood stove tax credit.

Wood Burning Stove Tax Credit 2025. Keep in mind that if you buy a wood or pellet stove in 2025 but have it installed in 2025, your tax credit will be applied to your 2025 tax return. From january 1, 2025, to december 31, 2032, homeowners can get a tax credit of 30% on both the purchase and installation of eligible wood.

Heritage HearthStone Stoves, Congress removed biomass stoves from section 25 (c), which had provided a $300 tax credit up until dec. An epa or csa emission certified wood stove:

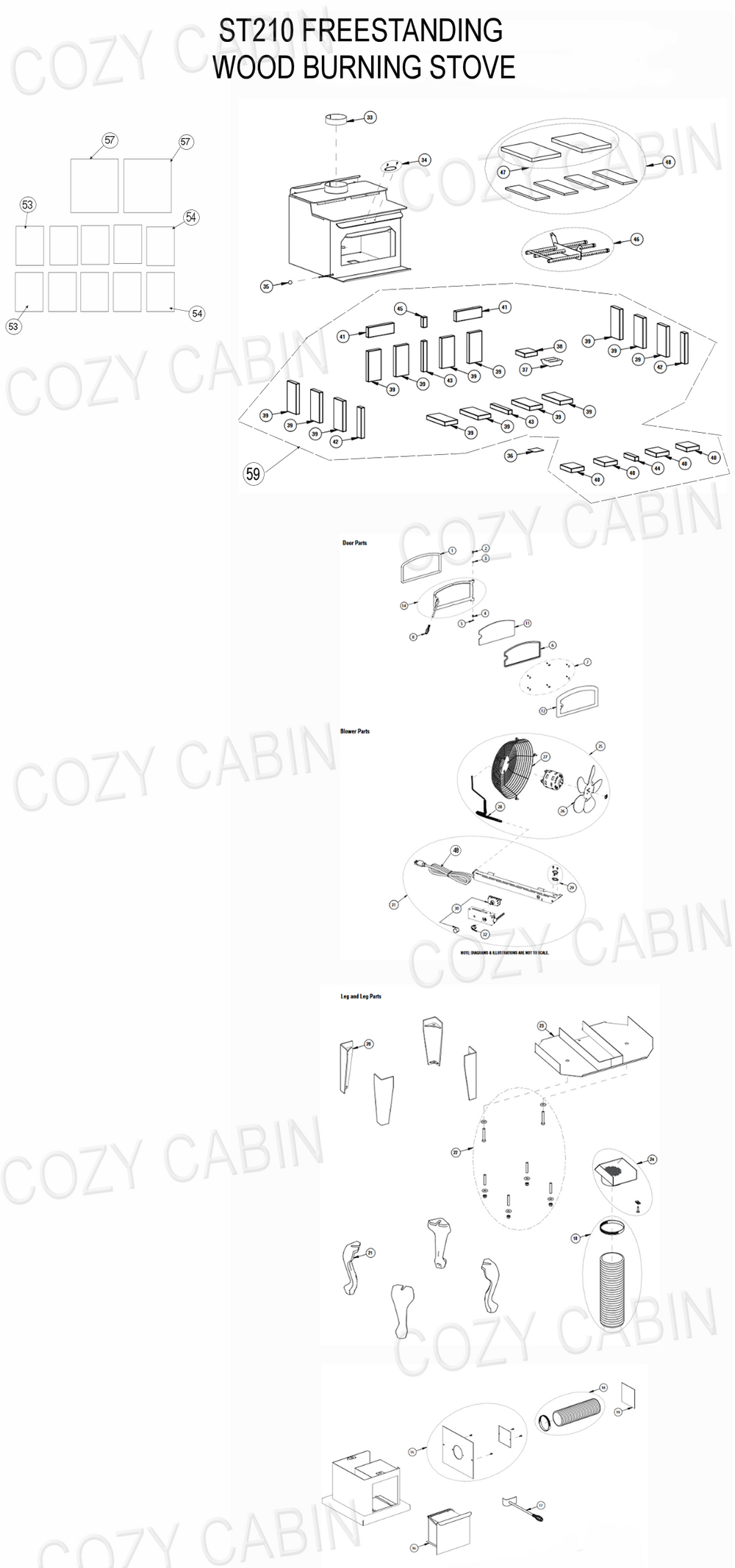

County Collection Freestanding Wood Burning Stove (ST210) (ST210) The, An epa or csa emission certified wood stove: The appliance was finally installed in feb 2025, at which point we paid the remaining $4k.

Tax Credit Wood and Pellet Stoves The Stove Center, What is the 26% tax credit for wood stoves? From january 1, 2025, to december 31, 2032, homeowners can get a tax credit of 30% on both the purchase and installation of eligible wood.

Consumers buying highly efficient wood stoves will be able to claim a 30% tax credit that is based on the full cost of the wood stove, including purchase and installation. Qualifying products include 2020 epa certified wood stoves or inserts with a listed efficiency of 75% or better.

Two main types of wood stoves meet epa standards for efficiency and emissions.

Pleasant Hearth 1,200 sq. ft. EPA Certified WoodBurning Stove The, The appliance was finally installed in feb 2025, at which point we paid the remaining $4k. Shop fireplaces and stoves here :