Dependent Care Fsa Limit 2025 Irs - Dependent Care Fsa 2025 Limit Sande Cecelia, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year. Irs Dependent Care Fsa Limits 2025 Ollie Atalanta, — what are the 2025 allowable amounts for the dependent care assistance program (dcap)?

Dependent Care Fsa 2025 Limit Sande Cecelia, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

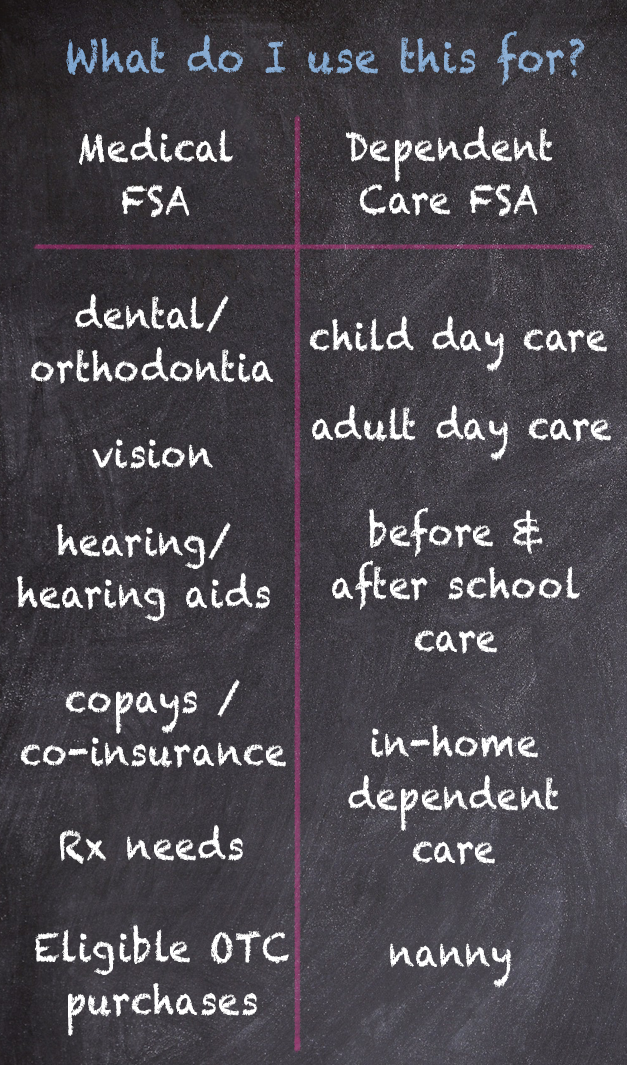

Dependent Care Fsa 2025 Contribution Limits Irs Sande Cecelia, — dental and vision care ;

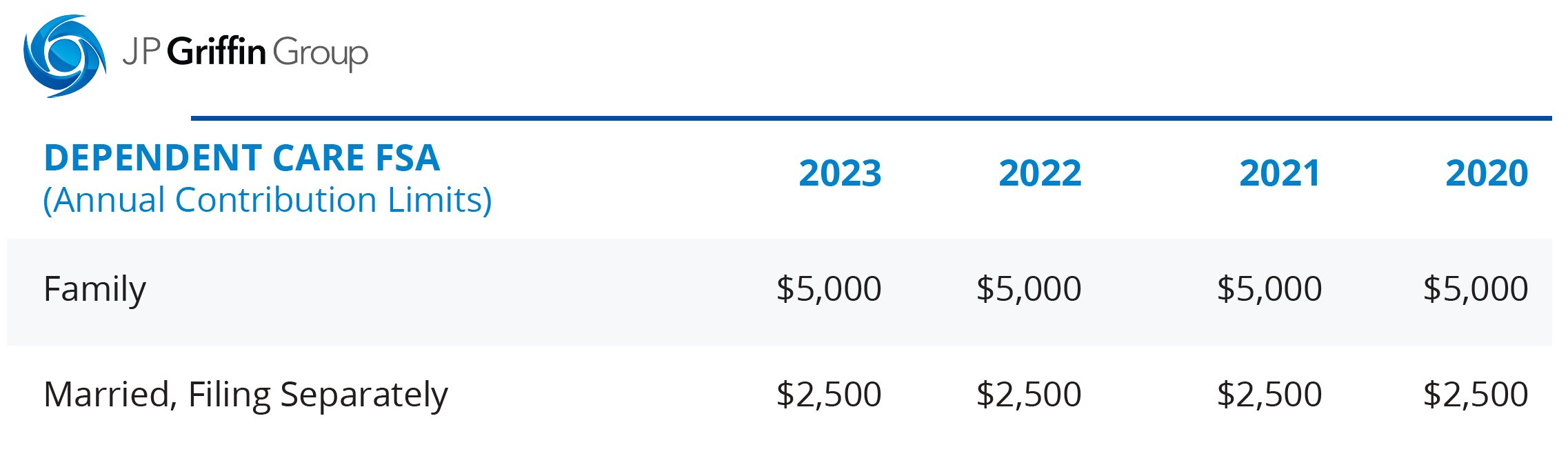

What Is Dependent Care Fsa 2025 Lanna Annalee, It remains at $5,000 per household or $2,500 if married, filing separately.

When Will Irs Release 2025 Fsa Limits Tammy Philippine, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Dependent Care Fsa Limit 2025, Fsas will also experience heightened contribution limits next year.

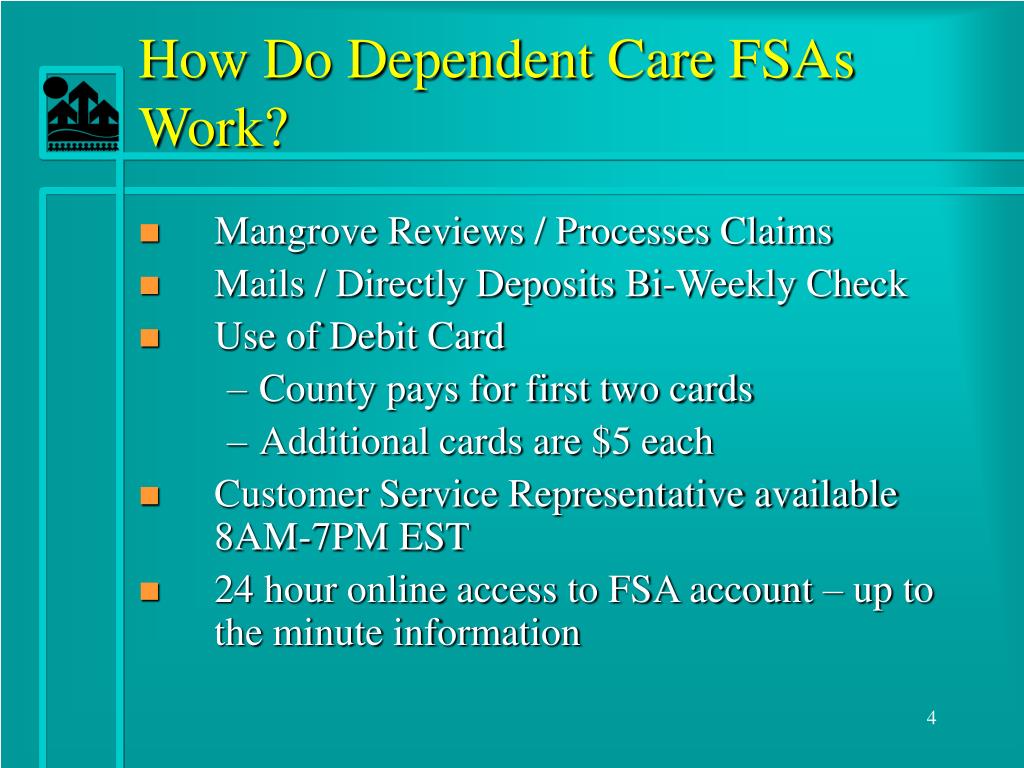

Irs Dependent Care Fsa Limits 2025 Vivia Raychel, If you received any dependent care benefits from your employer during the year, you may be able to exclude all or part of them from your income.

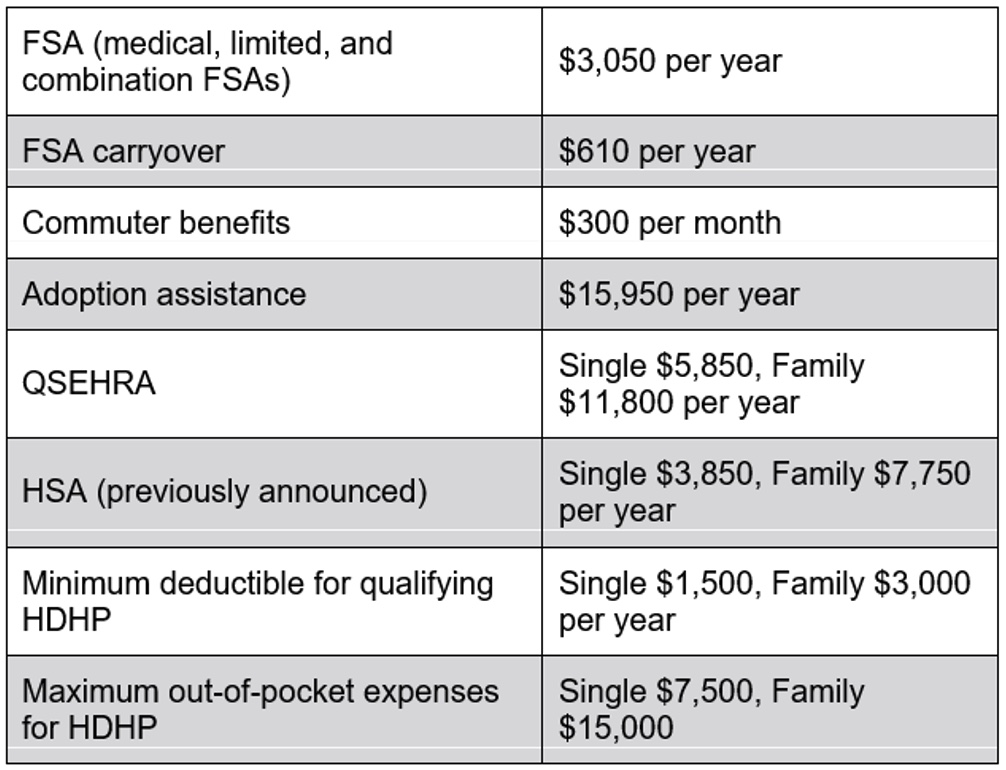

2025 Fsa Plan Limits Over 50 Dulcia Margaret, — the annual limit on employee contributions to a health fsa will be $3,200 for plan years beginning in 2025 (up from $3,050 in 2025).

Dependent Care Fsa Contribution Limit 2025 2025 Aurie Carissa, The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa.

Dependent Care Fsa Limit 2025 Irs. You can contribute up to $5,000 in 2025 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a. Each year the irs announces updates to contribution limits for flexible spending accounts (fsa), health savings accounts (hsa), health reimbursement arrangements (hra), and.

Dependent Care Fsa Limit 2025 Irs Suzi Zonnya, 2025 flexible spending arrangement contribution limit rises by $150 | internal revenue service.

The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa. 2025 flexible spending arrangement contribution limit rises by $150 | internal revenue service.